From groceries to housing, the cost of living is weighing on everyone’s mind. It doesn’t help that we’re overwhelmed with news about economic and political uncertainty, causing many Canadians to fear for their jobs.

The good news is, taking steps now to save for the future can help you establish a sense of financial security. The saying “better late than never” is especially relevant when it comes to savings!

Canadians Understand the Value of Savings

When I meet with an individual who’s less than 20 years from retirement, their number one financial regret is typically not saving early enough. Often, they wish they’d paid attention to their long-term savings goals in a more thoughtful and strategic way. If only they could tell their younger selves to be smarter with their savings.

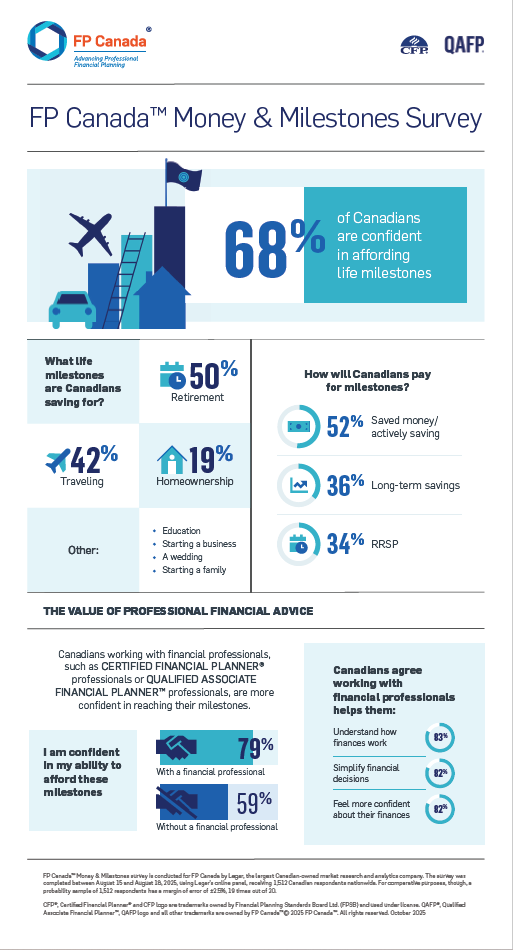

This is something that Canadians of all ages experience. According to the 2025 FP Canada™ Financial Stress Index, 22% of those aged 18-34, 20% of those 35-54, and 21% of individuals aged 55+ say their biggest financial regret is not saving more money or not saving earlier.

Nearly half (48%) of Canadians say saving more would help them reduce financial stress, and this is consistent across all age groups. Fifty-nine per cent of those 18-34, 51% of those 35-54, and 37% of respondents over 55 say this is the true. These statistics show that, regardless of age, most Canadians understand the importance of saving at every stage of their financial journeys.

Smart Money Tips to Help You Get Ahead

Canadians shouldn’t feel discouraged, even if they’re starting to focus on savings later in life. Every little bit counts—and it doesn’t matter what age you are.

Here are some easy ways to start saving:

- Automate your savings. Set up automated payments to be deposited into helpful accounts, such as RRSPs or TFSAs. An RRSP can help you grow your savings tax free and provide a tax deduction (though they’re taxable upon withdrawal in retirement). TFSAs don’t provide a tax deduction, but they allow you to grow and withdraw from your savings on a tax-free basis. It’s important to discuss which strategy or combination of strategies makes the most sense for your situation with your financial planner.

- Contribute to employment savings plans. This strategy forces you to save money before it lands in your bank account. It’s especially valuable when the employer is contributing because that’s essentially free money!

- Understand your income and expenses. Take time to see how much money is coming in and how much is going out so you’re clear on which expenses you can adjust or reduce (i.e., subscriptions).

- Read your credit card statement. Go through your monthly statements line item by line item–this is not a one-and-done exercise. It should be done on a monthly basis.

- Build an emergency fund. Grow your emergency fund (at least three months' worth of expenses) to handle unplanned events.

- Review your employee benefits. See what’s covered so you don’t end up paying for things unnecessarily.

- Forced savings are key. Increase your savings when you receive a pay increase.

- Get a handle on your debt. Debts can include mortgages, student loans, credit cards, and lines of credit. If you don’t pay your debt off, it can be a roadblock to saving for the future! Strategize to eliminate it by looking at the balances of each debt coupled with the interest rates associated with it. Your financial planner can help you prioritize which ones to pay down first.

Ask for Professional Guidance

CFP® professionals and QAFP® professionals play an important role in helping Canadians achieve financial well-being. They’re trained to provide advice that’s unique to their clients’ situations, enabling the individuals they work with to feel confident and empowered to make the right financial decisions.

You may not know how best to allocate your money towards your savings to achieve your goals, and that’s okay. Over half (52%) of Canadians fear making the wrong financial decision, according to the Financial Stress Index. Fortunately, a financial planner can help you overcome your financial stress and take action.

To find the right CFP professional or QAFP professional near you, use the Find Your Financial Planner tool.

Kelly Ho, CFP, is Partner at DLD Financial Group Ltd. in Vancouver.

Find Your Financial Planner

Find Your Financial Planner