Whether you’re expecting a big refund or you owe the government money, planning ahead is the key to reducing financial stress and improving your financial health.

Thinking Through Your Tax Options

Many Canadians have already begun filing their income taxes in anticipation of early tax refunds. Will you be getting one this year? If so, what will you do with it?

It’s beneficial to understand the ways in which proper tax planning can have a positive effect on your financial goals and current priorities. Get started with some useful tips to help you plan for tax season — and make the most of potential tax-planning opportunities.

Evaluating Your Tax Returns

The size of the refund you’ll receive or the tax bill you’ll owe shouldn’t surprise you. There are a variety of tax software packages and online calculators you can use to estimate these numbers. Having approximate figures before you file your tax return can help ensure that your financial expectations are realistic.

If your refund is larger than expected, or you owe the government more than anticipated, understanding why is crucial. Sometimes, it can indicate that you’ve missed the opportunity to claim deductions, credits, or expenses, or have omitted information from your tax return. Speak with your financial planner, talk to your payroll department, or view your Canada Revenue Agency account to get a more complete sense of your financial picture.

It’s possible that the tax credits you claimed in previous years no longer apply. Maybe you’ve cut back on your registered account contributions and incorrectly adjusted your TD1 form. If you have a side hustle that provides additional income, that could also affect your taxes! Depending on how the profits factor into total annual income, the result could be more income tax than expected.

Working with a CFP professional or QAFP® professional can make tax planning easier. These experts will work with you to ensure you cover all your bases and recognize your blind spots.

Maximizing and Assessing Tax Refunds

Receiving a tax refund is a great feeling. It’s all too easy to bend your financial rules and splurge on immediate luxuries. While very restrictive financial plans aren’t always a good idea, using influxes of cash in a thoughtful way can be highly beneficial. Possible ways to maximize tax refund opportunities might include the following:

- Investing as part of your comprehensive financial plan

- Building or adding to your emergency fund through a Tax-Free Savings Account (TFSA)

- Paying down consumer loans such as credit card debt or lines of credit

Having a complete view of your financial circumstances can help you use your tax refund to your advantage. Ideally, it will help set you up for success in achieving your mid- and long-term financial goals.

Get the Help You Need

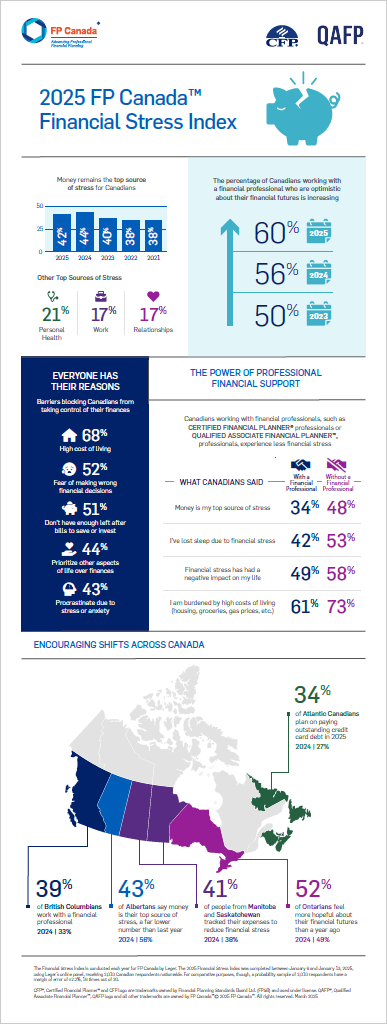

Despite the financial pressure resulting from the current cost of living, FP Canada’s Fall Consumer Survey found that only 40% of Canadians have a financial plan in place. Even fewer work with a financial planner (11%). Among those who don’t have a plan, one in five (21%) under the age of 35 said they don’t know where to start.

Working with a CFP professional or QAFP professional who truly understands your priorities and vision for the future will help you better understand your finances — and your next steps. The right professional will help you plan for and make the most of your tax refund or bill.

When it comes to tax planning, having a practical financial plan that focuses on the goals that are most important to you and your loved ones will help you achieve financial well-being.

To find a CFP professional or QAFP professional who can help you with your tax planning and return, use our Find Your Planner tool.

Iftikhar Mahmood is a CFP professional at CreateWealth Planning.

Find Your Financial Planner

Find Your Financial Planner