Understanding your credit score can help you see the big picture when it comes to your finances.

If you’re hoping to make a positive change related to your finances, understanding and improving your credit score is key. This three-digit number, which reveals how well you manage credit, is used by lenders to determine the risk associated with lending you money.

Here are a few ways to improve your credit score.

Pay Your Bills on Time

Paying your bills on time is foundational to maintaining a good credit score. Past due bills or debts are sent to a collection agency, and they can stay on your report for up to six years. Banks and other lenders look at your credit score before issuing you a loan. If your credit score is low or under review, these lenders may decline your loan, which can impact your ability to buy a home or start a business (among other things).

One of the easiest ways to avoid missing payments is by setting up automatic payment plans through your bank, or by scheduling monthly reminders.

As an added tip, regularly check your credit score for accuracy. It’s possible that your credit history could contain mistakes, so take the time to review your credit reports online through both Equifax and TransUnion.

Lower Your Credit Utilization Ratio

Another way to boost your credit score is by ensuring you don’t use all your available credit. The amount of credit you have versus the amount you’ve used is known as your credit utilization ratio. A good ratio to aim for is anything under 30 per cent. For example, if you have $10,000 of credit available to you per month, try and use less than $3,000.

Keeping your ratio low is important. A high ratio can indicate that you may be at risk of going over your limit. To keep your ratio low, try to make frequent credit card payments and consider applying for higher credit limits on your cards.

Keep Old Accounts Open

The longer you have a credit account open and in use, the better it is for your credit score. Following that logic, maintaining old accounts can help improve your credit score. In fact, the average age of your accounts is a factor Equifax uses to determine your score. Even if you have a new credit card, it’s best to use your old accounts from time to time, just to keep them active.

Decrease Your Debt-to-Income Ratio

Debt-to-income ratio (DTI) is the total amount of debt you owe divided by your monthly gross income (total income before taxes).

According to Equifax, if you owe $2,000 in debt each month and your monthly gross income is $6,000, your DTI ratio would be 33 per cent. This means you spend 33 per cent of your monthly income on your debt payments. A lower DTI indicates that you have more disposable income and greater financial stability.

Like your credit utilization ratio, your DTI ratio impacts your status with lenders. If you’re applying for a mortgage, lenders prefer a DTI below 36 per cent, though they may accept up to 43 per cent.

Get an Expert Opinion

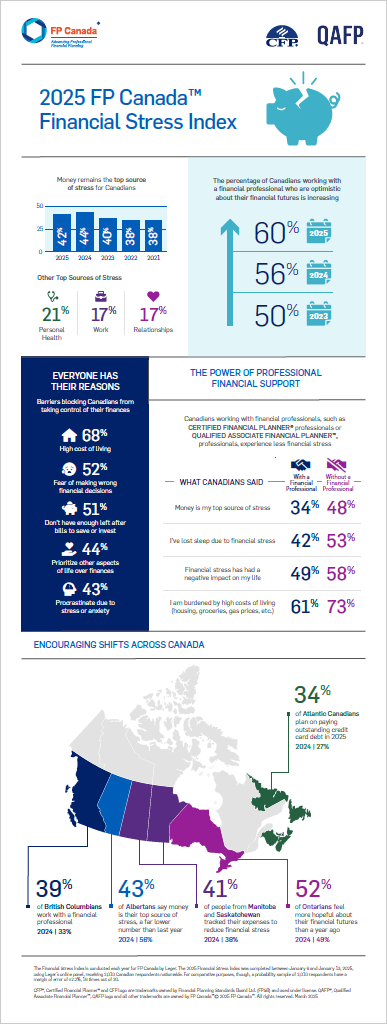

When you’re working to manage your credit — and your finances in general — you don’t have to do it alone. Working with a CFP® professional or QAFP® professional can help you tackle your credit score with confidence.

To find a helpful CFP professional or QAFP professional near you, use the Find Your Planner tool.

David Christianson is a CFP professional at Christianson Wealth Advisors and National Bank Financial.

Find Your Financial Planner

Find Your Financial Planner